HONG KONG MONTHLY RESEARCH OCTOBER 2015 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET. Office Grade-A office vacancy rates even lower

|

|

|

- Edmund Hensley

- 5 years ago

- Views:

Transcription

1 RESEARCH OCTOBER 2015 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Grade-A office vacancy rates even lower Residential Primary home sales surge but secondary decline Retail Retail property market saw signs of stablising

2 MARKET HIGHLIGHTS The Grade-A office market did not see many activities last month despite robust demand due to an extremely tight supply situation, with the overall average vacancy rate reaching as low as 1.7% in September. The residential market saw more secondary homeowners slashed asking prices to boost sales, amid fierce competition from the primary sector and a potential interest-rate rise. The retail market remained subdued, but there were signs of stabilising with space being quickly snapped up given rental discounts. TABLE 1 Economic indicators and forecasts Economic indicator Period Latest reading GDP growth Q %# +1.7% +2.9% +2.3%# Inflation rate Aug % +4.1% +4.3% +4.4% Unemployment Jun Aug %# 3.1% 3.3% 3.2% Prime lending rate Current % 5%* 5%* 5%* Source: EIU CountryData / Census & Statistics Department / Knight Frank Research # Provisional * HSBC prime lending rate FIGURE 1 Grade-A office prices and rents Jan 2007 = PRICE INDEX RENTAL INDEX Prime Office Despite strong leasing demand, the Grade-A office market was stable last month amid limited available space, particularly in core business areas. Most firms opted for renewing their leases rather than relocation due to a lack of alternatives. The key demand drivers remained Mainland Chinese firms, which continued to favour Central for setting up offices. As a result, Central s vacancy rate dropped a further 0.2 percentage point to an extremely low level of 1.4% in September, close to the historical low in An increasing trend of operation split was witnessed in the office market due to a lack of vacant space. Many firms have to split their operations into smaller offices located in different buildings. Previously, only major firms requiring large premises needed to split their offices, but now even firms requiring units of below 10,000 sq ft are going for such arrangement. With the tight supply and many offices under multiple offers, landlords have become more aggressive in asking rents. If the trend continues, it could be possible to see a reversed premium situation next year firms requiring large office space have to pay an even higher per-square-foot rental. Looking ahead, given sustained demand and low vacancy rates, we remain positive towards the long-term outlook for Grade-A offices in Hong Kong. We expect rents in Central to increase 10% this year and another 5% in In Kowloon East, Grade-A office rents could drop 0-5% next year with increased supply. 2

3 HONG KONG MONTHLY RESEARCH FIGURE 2 Luxury residential prices and rents Jan 2007 = FIGURE 3 Retail property prices and rents Jan 2007 = PRICE INDEX RENTAL INDEX Source: Rating and Valuation Department / Knight Frank Research Note: Provisional figures from Mar 2015 to Aug 2015 Residential According to the Land Registry, residential sales rebounded 9.4% from August to 4,263 in September. First-hand transactions jumped 110%, while secondary sales declined 15%, month on month (MoM). Both demand and supply remained robust in the primary market, with around 360 units launched during the Mid-Autumn Festival holiday. For example, 110 units in Century Link in Tung Chung and over 200 flats in Upper East in Hung Hom were snapped up within just a few hours. In contrast, the secondary market remained subdued last month, amid the recent stock market volatility, a potential interest-rate rise in the US and fierce competition from primary developments. The Chief Executive has announced that the stamp duty policies will remain in place in the near term. We do not expect home prices to drop significantly. We have found that a 100-bps increase in mortgage rates will only result in a HK$500 increment in monthly instalment for every HK$1 million of mortgage loan, based on a 20-year repayment period. Therefore, a minor interest-rate hike is not expected to lead to a significant default risk. On the other hand, market views do not expect a drastic interest-rate hike this year. Retail Government data continued to indicate further deterioration of the local retail environment. The total retail sales value in August decreased 5.4% year on year (YoY) to HK$37.9 billion with slower inbound tourism. Total visitor arrivals in August decreased 6.6% YoY, more than the decline of 2.9% in July. Prime street shop landlords were under pressure in rental negotiations. For instance in Causeway Bay, a number of tenants in Russell Street reportedly received over 30% rental concessions on lease renewal, while cosmetics retailer Colourmix reportedly preleased the shop at 18 Russell Street for a monthly rent of HK$1 million, about 40% lower than the existing rent. Meanwhile, sportswear retailer Adidas took up the shop at 36 Queen s Road Central in Central formerly occupied by Coach for a rent about 22% cheaper. Having dropped about 10% during the first three quarters, rents of prime street shops are expected to drop further this year. However, there are signs of stabilisation as spaces are usually snapped up quickly provided discounts are offered. The recent rental corrections will bring new tenants to and promote diversity in prime streets, changing the landscape and benefiting the future local retail market in the longer term. 3

4 SNAPSHOT PRIME OFFICE In September, a number of major office sales transactions were recorded in Kowloon (Table 2). Last month, AIA leased a large office premise at 633 King s Road in North Point (Table 3). TABLE 2 Selected office sales transactions District Building Zone Sheung Wan Shun Tak Centre Gross floor area (sq ft) Price (HK$ million) Price (HK$ per sq ft) Mid 2,752 $51.8 $18,823 Tsim Sha Tsui Railway Plaza Mid 10,880 $155.6 $14,300 Kowloon Bay Enterprise Square Three Mid 8,970 $109.9 $12,250 Kwun Tong Legend Tower Mid 2,080 $21.6 $10,400 Source: Economic Property Research Centre TABLE 3 Selected office leasing transactions District Building Zone Floor area (sq ft) North Point 633 King s Road Mid 30,135 (G) Kowloon Bay Skyline Tower Mid 27,748 (G) Kowloon Bay YHC Tower High 11,430 (G) Central Man Yee Building Mid 8,500 (L) 4

5 HONG KONG MONTHLY RESEARCH SNAPSHOT In September, Grade-A office rents in all major business districts increased MoM (Table 4). TABLE 4 Month-on-month movement of Grade-A office rents (Sep 2015) Central / Admiralty Wan Chai / Causeway Bay Quarry Bay Tsim Sha Tsui Kowloon East Grade-A office prices declined for the third consecutive month in September, after hitting record highs in June (Table 5). TABLE 5 Prime office market indicators (Sep 2015) Net effective rent Change Price Change District Premium Central Traditional Central Overall Central HK$ psf / mth Aug 15 Jun 15 Sep 14 HK$ psf Aug 15 Jun 15 Sep 14 $ % 4.6% 4.3% n/a n/a n/a n/a $ % 4.2% 7.3% n/a n/a n/a n/a $ % 4.3% 6.0% $27, % -4.7% 6.4% Admiralty $ % 5.9% 12.1% $22, % -4.1% 6.6% Sheung Wan $ % 8.1% 19.1% $20, % -7.2% 5.4% Wan Chai $ % 4.8% 9.2% $19, % -4.8% 10.2% Causeway Bay $ % 4.4% 9.0% $20, % -4.0% 11.5% North Point $ % 8.7% 13.1% n/a n/a n/a n/a Quarry Bay $ % 3.4% 7.9% n/a n/a n/a n/a Tsim Sha Tsui Cheung Sha Wan $ % 6.6% 14.4% $12, % -4.1% 7.8% $ % 1.7% 7.7% n/a n/a n/a n/a Hung Hom $ % -6.6% -11.7% n/a n/a n/a n/a Kowloon East Mong Kok / Yau Ma Tei $ % 1.4% 1.4% $11, % -5.1% -0.1% $ % -0.9% 3.5% n/a n/a n/a n/a Rents and prices are subject to revision. 5

6 SNAPSHOT RESIDENTIAL In September, a number of major luxury residential sales transactions were concluded in Ho Man Tin (Table 6). Last month, Island South witnessed a number of luxury residential leasing transactions (Table 7). TABLE 6 Selected residential sales transactions District The Peak Building OPUS HONG KONG Ho Man Tin Ultima Phase 1 Tower / floor / unit Saleable area (sq ft) Price (HK$ million) Price (HK$ psf) Mid floor unit 5,154 $387.0 $75,087 Tower 6 / high floor unit 2,050 $100.5 $49,024 Mid-Levels Grenville House Low floor unit 3,280 $109.8 $33,476 Ho Man Tin 5-7 Ho Man Tin Street N/A 41,060 $628.0 $15,295 Source: Economic Property Research Centre TABLE 7 Selected residential leasing transactions District Building Tower / floor / unit Saleable area (sq ft) Monthly rent (HK$) Monthly rent (HK$ psf) The Peak Kelletteria House 2,423 $167,900 $69.3 Island South Happy Valley Island South Pokfulam 9 South Bay Road House 2,784 $185,000 $66.5 The Leighton Hill A unit 1,113 $73,000 $ Deep Water Bay Road Residence Bel-Air House 2,882 $178,000 $61.8 A unit 1,412 $73,800 $52.3 6

7 HONG KONG MONTHLY RESEARCH SNAPSHOT In September, rents remained stable in three of the five major luxury residential districts (Table 8). TABLE 8 Month-on-month movement of luxury residential rents (Sep 2015) Peak Island South Mid-Levels Jardine s Lookout / Happy Valley Pokfulam Luxury residential prices decreased in Island South, Mid-Levels and Pokfulam last month (Table 9). TABLE 9 Luxury residential market indicators (Sep 2015) Rent Change Price Change District HK$ psf / mth Aug 15 Jun 15 Sep 14 HK$ psf Aug 15 Jun 15 Sep 14 The Peak $ % -2.5% 0.1% $41, % 0.0% 5.2% Island South Mid- Levels Jardine s Lookout / Happy Valley $ % -0.5% -0.9% $28, % -7.6% -9.3% $ % 0.3% 4.7% $26, % -1.8% 4.4% $ % 1.0% -0.1% $26, % 1.0% 9.3% Pokfulam $ % 0.2% 1.4% $24, % -3.3% 5.7% Rents and prices are subject to revision. 7

8 SNAPSHOT RETAIL A few major retail property sales deals were recorded in Sheung Wan last month (Table 10). Prime retail districts recorded a number of major leasing transactions in September (Table 11). TABLE 10 Selected retail sales transactions District Building Floor / unit Wan Chai Kowloon City Cheung Lok Mansion 81 Lion Rock Road Ground floor / unit B Saleable floor area (sq ft) Price (HK$ million) Price (HK$ psf) 334 $48.0 $143,713 Ground floor 694 $28.0 $40,346 Sheung Wan Lyndhurst Building Ground floor / units 4A:G N/A $74.0 N/A Sheung Wan 21 Elgin Street Lower ground floor N/A $61.5 N/A Source: Economic Property Research Centre TABLE 11 Selected retail leasing transactions District Building Floor / unit Saleable floor area (sq ft) Monthly rent (HK$) Monthly rent (HK$ psf) Tsim Sha Tsui Causeway Bay Causeway Bay Tsim Sha Tsui Hankow Centre Arcade Burlington House Po Foo Building Island Beverley Ground floor / unit 16 Ground to 1st floors / units A Ground floor / unit D Ground floor / units B1-B2 373 $550,000 $1, $480,000 $ $238,000 $451.6 N/A $1,643,000 N/A Source: Economic Property Research Centre 8

9 HONG KONG MONTHLY RESEARCH SNAPSHOT In September, prime street shop rents decreased across all major retail districts (Table 12). TABLE 12 Month-on-month movement of prime street shop rents (Sep 2015) Central Causeway Bay Tsim Sha Tsui Mong Kok In August, the total retail sales value decreased 5.4% YoY, to settle at HK$37.9 billion (Table 13). TABLE 13 Retail sales by outlet type (Aug 2015) Value Share of total Change Outlet (HK$ billion) % Jul 15 May 15 Aug 14 Jewellery, watches and clocks and valuable gifts Clothing, footwear and allied products $ % 5.4% 16.0% -8.8% $ % -10.2% -15.5% -12.0% Department stores $ % 5.8% -22.4% -8.6% Fuel $ % 4.4% 1.0% -7.3% Food, alcoholic drinks and tobacco (excluding supermarkets) $ % 10.0% 6.3% -10.2% Consumer durable goods $ % -0.2% -4.4% 9.5% Supermarkets $ % 3.5% 4.3% 0.4% Others $ % -3.6% -5.0% -7.9% All retail outlets $ % 0.9% -2.9% -5.4% Source: Census and Statistics Department / Knight Frank Research 9

10 RESEARCH & CONSULTANCY David Ji Director Head of Research & Consultancy Greater China Pamela Tsui Senior Manager Research & Consultancy Greater China Knight Frank Residential Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. RECENT MARKET-LEADING RESEARCH PUBLICATIONS AP Prime Office Rental Index Q Prime Global Cities Index Q Knight Frank Research Reports are available at KnightFrank.com/Research Hotel Report 2015 Wealth Report 2015 CONTACTS Alan Child Chairman alan.child@hk.knightfrank.com Colin Fitzgerald Managing Director colin.fitzgerald@hk.knightfrank.com Paul Hart Executive Director Greater China paul.hart@hk.knightfrank.com Alnwick Chan Executive Director alnwick.chan@hk.knightfrank.com CHINA VALUATION Clement Leung Executive Director clement.leung@hk.knightfrank.com COMMERCIAL AGENCY Ross Criddle Director ross.criddl@hk.knightfrank.com RESIDENTIAL AGENCY Renu Budhrani Executive Director renu.budhrani@hk.knightfrank.com RETAIL SERVICES Mont Leung Director Retail Services and Asset Management mont.leung@hk.knightfrank.com Knight Frank 萊坊 2015 Knight Frank Petty Limited Knight Frank Hong Kong Limited Disclaimer This document and the material contained in it is general information only and is subject to change without notice. All images are for illustration only. No representations or warranties of any nature whatsoever are given, intended or implied. Knight Frank will not be liable for negligence, or for any direct or indirect consequential losses or damages arising from the use of this information. You should satisfy yourself about the completeness or accuracy of any information or materials. Copyright This document and the material contained in it is the property of Knight Frank and is given to you on the understanding that such material and the ideas, concepts and proposals expressed in it are the intellectual property of Knight Frank and protected by copyright. It is understood that you may not use this material or any part of it for any reason other than the evaluation of the document unless we have entered into a further agreement for its use. This document is provided to you in confidence on the understanding it is not disclosed to anyone other than to your employees who need to evaluate it 10

HONG KONG MONTHLY RESEARCH JANUARY 2018 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH JANUARY 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Grade-A office rents in Kowloon East to rebound this year Residential Interest-rate rise is not expected

RESEARCH JANUARY 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Grade-A office rents in Kowloon East to rebound this year Residential Interest-rate rise is not expected

HONG KONG MONTHLY RESEARCH APRIL 2018 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET. Office Decentralisation and relocation continue

RESEARCH APRIL 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Decentralisation and relocation continue Residential Hong Kong prime rates remain und despite US interest

RESEARCH APRIL 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Decentralisation and relocation continue Residential Hong Kong prime rates remain und despite US interest

HONG KONG MONTHLY RESEARCH NOVEMBER 2015 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH NOVEMBER 2015 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Abundant availability to emerge in Kowloon next year Residential Home sales hit 19-month low with slower

RESEARCH NOVEMBER 2015 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Abundant availability to emerge in Kowloon next year Residential Home sales hit 19-month low with slower

HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

APRIL 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Decentralisation and relocation continue Residential Hong Kong prime rates remain und despite US interest rate hikes

APRIL 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Decentralisation and relocation continue Residential Hong Kong prime rates remain und despite US interest rate hikes

HONG KONG MONTHLY RESEARCH FEBRUARY 2016 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH FEBRUARY 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Economic uncertainties to affect demand sustainability Residential Home sales hit 25-year low following

RESEARCH FEBRUARY 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Economic uncertainties to affect demand sustainability Residential Home sales hit 25-year low following

HONG KONG MONTHLY RESEARCH NOVEMBER 2017 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH NOVEMBER 2017 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office The Center was sold at a record high price of HK$40.2 billion Residential Limited impact on residential

RESEARCH NOVEMBER 2017 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office The Center was sold at a record high price of HK$40.2 billion Residential Limited impact on residential

HONG KONG MONTHLY RESEARCH MARCH 2018 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET. Office Prime site in West Kowloon under spotlight

RESEARCH MARCH 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Prime site in West Kowloon under spotlight Residential Secondary residential sales saw improvement Retail

RESEARCH MARCH 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Prime site in West Kowloon under spotlight Residential Secondary residential sales saw improvement Retail

HONG KONG MONTHLY RESEARCH DECEMBER 2017 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH DECEMBER 2017 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET 0 Office Grade-A office leasing activity more than doubled in Kowloon Residential Home prices to rise another

RESEARCH DECEMBER 2017 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET 0 Office Grade-A office leasing activity more than doubled in Kowloon Residential Home prices to rise another

HONG KONG MONTHLY RESEARCH NOVEMBER 2016 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH NOVEMBER 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Mega en-bloc office sales transaction recorded in Kowloon Residential Prices to remain stable despite

RESEARCH NOVEMBER 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Mega en-bloc office sales transaction recorded in Kowloon Residential Prices to remain stable despite

HONG KONG MONTHLY RESEARCH DECEMBER 2016 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH DECEMBER 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Abundant supply in Kowloon should suppress rental growth Residential Large-scale deals concluded despite

RESEARCH DECEMBER 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Abundant supply in Kowloon should suppress rental growth Residential Large-scale deals concluded despite

HONG KONG MONTHLY RESEARCH MAY 2018 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET. Office More consolidation activity in Kowloon East

RESEARCH MAY 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office More consolidation activity in Kowloon East Residential Housing supply shortage will remain in the short

RESEARCH MAY 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office More consolidation activity in Kowloon East Residential Housing supply shortage will remain in the short

HONG KONG MONTHLY RESEARCH MAY 2016 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH MAY 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Expansion activity sluggish apart from insurance companies Residential Sales grow further but prices continue

RESEARCH MAY 2016 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Expansion activity sluggish apart from insurance companies Residential Sales grow further but prices continue

HONG KONG MONTHLY RESEARCH FEBRUARY 2018 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH FEBRUARY 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Surrendered space by Chinese firms swiftly taken up by MNCs Residential Relocation trend witnessed in

RESEARCH FEBRUARY 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Surrendered space by Chinese firms swiftly taken up by MNCs Residential Relocation trend witnessed in

HONG KONG MONTHLY RESEARCH JUN 2017 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

RESEARCH JUN 2017 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Major commercial land sales to set new price benchmarks Residential Home prices to rise 5-10% over 2017 despite

RESEARCH JUN 2017 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Major commercial land sales to set new price benchmarks Residential Home prices to rise 5-10% over 2017 despite

HONG KONG PRIME OFFICE Monthly Report

RESEARCH MARCH 2010 HONG KONG PRIME OFFICE Monthly Report Office market rally continues Hong Kong s economy showed further signs of recovery this past month, benefiting from a revival in regional trade,

RESEARCH MARCH 2010 HONG KONG PRIME OFFICE Monthly Report Office market rally continues Hong Kong s economy showed further signs of recovery this past month, benefiting from a revival in regional trade,

Hong Kong Prime Office Monthly Report. September 2011 RESEARCH NON-CORE DISTRICTS LEAD THE MARKET

RESEARCH September 2011 Hong Kong Prime Office Monthly Report NON-CORE DISTRICTS LEAD THE MARKET Sentiment in the office market remained mixed over the past month. The sales market was relatively quiet,

RESEARCH September 2011 Hong Kong Prime Office Monthly Report NON-CORE DISTRICTS LEAD THE MARKET Sentiment in the office market remained mixed over the past month. The sales market was relatively quiet,

Hong Kong Prime Office Monthly Report. October 2011 RESEARCH NON-CORE DISTRICTS LEAD THE MARKET

RESEARCH October 2011 Hong Kong Prime Office Monthly Report NON-CORE DISTRICTS LEAD THE MARKET Business and investment activity slowed in Hong Kong over the past month, on the back of negative economic

RESEARCH October 2011 Hong Kong Prime Office Monthly Report NON-CORE DISTRICTS LEAD THE MARKET Business and investment activity slowed in Hong Kong over the past month, on the back of negative economic

Hong Kong Prime Office Monthly Report. August 2011 RESEARCH LEASING ACTIVITY ROBUST DESPITE VOLITILITY

RESEARCH August 2011 Hong Kong Prime Office Monthly Report LEASING ACTIVITY ROBUST DESPITE VOLITILITY Sentiment in the office sales market weakened over the past month. The slowdown was triggered by a

RESEARCH August 2011 Hong Kong Prime Office Monthly Report LEASING ACTIVITY ROBUST DESPITE VOLITILITY Sentiment in the office sales market weakened over the past month. The slowdown was triggered by a

HONG KONG PRIME OFFICE Monthly Report

RESEARCH February 2011 HONG KONG PRIME OFFICE Monthly Report RENTS TO SURPASS 2008 PEAKS BY YEAR-END Players in Hong Kong's office leasing market started the game of 'musical chairs' again at the beginning

RESEARCH February 2011 HONG KONG PRIME OFFICE Monthly Report RENTS TO SURPASS 2008 PEAKS BY YEAR-END Players in Hong Kong's office leasing market started the game of 'musical chairs' again at the beginning

Hong Kong Monthly. January 2014 RESEARCH REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET. OFFICE Activity subdued during the holiday season

RESEARCH January 2014 Hong Kong Monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET OFFICE Activity subdued during the holiday season Residential Market remains dominated by primary sales Retail

RESEARCH January 2014 Hong Kong Monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET OFFICE Activity subdued during the holiday season Residential Market remains dominated by primary sales Retail

HONG KONG PRIME OFFICE Monthly Report

RESEARCH April 2010 HONG KONG PRIME OFFICE Monthly Report Corporate sector eager to expand Hong Kong s office sales market continued to be active this past month. About 240 sales transactions were recorded

RESEARCH April 2010 HONG KONG PRIME OFFICE Monthly Report Corporate sector eager to expand Hong Kong s office sales market continued to be active this past month. About 240 sales transactions were recorded

Hong Kong Monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

Research August 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office s sustained across all major business districts Residential Residential supply to remain tight in the short term Retail

Research August 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office s sustained across all major business districts Residential Residential supply to remain tight in the short term Retail

Hong Kong Monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

Research March 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office New measures to suppress office sales Residential New measures to stabilise home prices Retail New measures to 1 dampen shop

Research March 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office New measures to suppress office sales Residential New measures to stabilise home prices Retail New measures to 1 dampen shop

Hong Kong Monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET

Research November 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Leasing market stable with expansions witnessed Residential Primary launches suppressed secondary market Retail Growth

Research November 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Office Leasing market stable with expansions witnessed Residential Primary launches suppressed secondary market Retail Growth

HONG KONG PRIME OFFICE Monthly Report

RESEARCH MAY 2010 HONG KONG PRIME OFFICE Monthly Report Yields set to rise Over the past month, Hong Kong s office sales market started to consolidate, following a strong period of recovery that started

RESEARCH MAY 2010 HONG KONG PRIME OFFICE Monthly Report Yields set to rise Over the past month, Hong Kong s office sales market started to consolidate, following a strong period of recovery that started

July 2012 Hong Kong Monthly

Research July 2012 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Office sales and leasing markets quieten Residential Luxury home sales remain sluggish Retail Investors shift

Research July 2012 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Office sales and leasing markets quieten Residential Luxury home sales remain sluggish Retail Investors shift

June 2012 Hong Kong Monthly

Research June 2012 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Office market regains momentum Residential Luxury home rents soften Retail New record set for retail property

Research June 2012 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Office market regains momentum Residential Luxury home rents soften Retail New record set for retail property

HONG KONG Luxury Residential Monthly Report

RESEARCH February 2011 HONG KONG Luxury Residential Monthly Report Prices rise WITH improved sentiment Government measures introduced in November 2010 to curb the surge in residential prices continued

RESEARCH February 2011 HONG KONG Luxury Residential Monthly Report Prices rise WITH improved sentiment Government measures introduced in November 2010 to curb the surge in residential prices continued

April 2012 Hong Kong monthly

Research April 2012 Hong Kong monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Office leasing market remains quiet Residential Luxury home leasing market stabilises Retail

Research April 2012 Hong Kong monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Office leasing market remains quiet Residential Luxury home leasing market stabilises Retail

HONG KONG Luxury Residential Monthly Report

RESEARCH October 2011 HONG KONG Luxury Residential Monthly Report Residential market remains quiet Last month, the fear of a global recession resulted in further drops in stock markets worldwide and continuing

RESEARCH October 2011 HONG KONG Luxury Residential Monthly Report Residential market remains quiet Last month, the fear of a global recession resulted in further drops in stock markets worldwide and continuing

February 2013 Hong Kong Monthly

Research February 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Absorption of vacant Grade-A offices in Central continued Residential Policy Address will have limited

Research February 2013 REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Absorption of vacant Grade-A offices in Central continued Residential Policy Address will have limited

HONG KONG Luxury Residential Monthly Report

RESEARCH September 2011 HONG KONG Luxury Residential Monthly Report Sales increase as prices soften With the global economic outlook uncertain and stock markets weak worldwide, sentiment in Hong Kong s

RESEARCH September 2011 HONG KONG Luxury Residential Monthly Report Sales increase as prices soften With the global economic outlook uncertain and stock markets weak worldwide, sentiment in Hong Kong s

HONG KONG Luxury Residential Monthly Report

RESEARCH January 2011 HONG KONG Luxury Residential Monthly Report Market regains momentum Hong Kong s residential sales market proved its resilience again last month, swiftly recovering from the impact

RESEARCH January 2011 HONG KONG Luxury Residential Monthly Report Market regains momentum Hong Kong s residential sales market proved its resilience again last month, swiftly recovering from the impact

HONG KONG Luxury Residential Monthly Report

RESEARCH AUGUST 2011 HONG KONG Luxury Residential Monthly Report PRICES STABLE DESPITE MARKET UNREST Sentiment in the local residential sales market remained lukewarm in July. Government measures to cool

RESEARCH AUGUST 2011 HONG KONG Luxury Residential Monthly Report PRICES STABLE DESPITE MARKET UNREST Sentiment in the local residential sales market remained lukewarm in July. Government measures to cool

HONG KONG Luxury Residential Monthly Report

RESEARCH March 2011 HONG KONG Luxury Residential Monthly Report Primary residential market revives In February 2011 the low season of Chinese New Year the residential market in Hong Kong was relatively

RESEARCH March 2011 HONG KONG Luxury Residential Monthly Report Primary residential market revives In February 2011 the low season of Chinese New Year the residential market in Hong Kong was relatively

HONG KONG MONTHLY RESEARCH OCTOBER 2018 REVIEW AND COMMENTARY ON HONG KONG S PROPERTY MARKET

RESEARCH OCTOBER 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG S PROPERTY MARKET Office Limited prime office space available before 2022 in Hong Kong Island Residential of primary and secondary

RESEARCH OCTOBER 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG S PROPERTY MARKET Office Limited prime office space available before 2022 in Hong Kong Island Residential of primary and secondary

HONG KONG Luxury Residential Monthly Report

RESEARCH August 2010 HONG KONG Luxury Residential Monthly Report low mortgage rates fuel market In late July, a luxury residential site in Mount Nicholson Road on the Peak was sold for more than HK$10

RESEARCH August 2010 HONG KONG Luxury Residential Monthly Report low mortgage rates fuel market In late July, a luxury residential site in Mount Nicholson Road on the Peak was sold for more than HK$10

HONG KONG. April 2011 RESEARCH. Japan disasters affect hk home sales. Monthly Report

RESEARCH April 2011 HONG KONG Luxury Residential Monthly Report Japan disasters affect hk home sales Following Hang Seng Bank s February move to limit the offering of HIBOR-linked mortgages to selected

RESEARCH April 2011 HONG KONG Luxury Residential Monthly Report Japan disasters affect hk home sales Following Hang Seng Bank s February move to limit the offering of HIBOR-linked mortgages to selected

HONG KONG Luxury Residential Monthly Report

RESEARCH July 2010 HONG KONG Luxury Residential Monthly Report Land auction stimulates market The auction of a luxury residential site in Ho Man Tin on 8th June represented a turning point in Hong Kong

RESEARCH July 2010 HONG KONG Luxury Residential Monthly Report Land auction stimulates market The auction of a luxury residential site in Ho Man Tin on 8th June represented a turning point in Hong Kong

Rents diverge in core and non-core areas. Figure 1. Retail rent performance diverged within the 2015F

PROPERTY INSIGHTS Hong Kong Quarter 4, 214 Rents diverge in core and non-core areas Market Overview Market Overview The overall net absorption rate 686,849 sq ft recorded in 214 was the highest reported

PROPERTY INSIGHTS Hong Kong Quarter 4, 214 Rents diverge in core and non-core areas Market Overview Market Overview The overall net absorption rate 686,849 sq ft recorded in 214 was the highest reported

PROPERTY INSIGHTS. Market Overview. Retail rents in core markets plunged further. Citigold Private Client. Hong Kong Quarter 3, 2015

Citigold Private Client PROPERTY INSIGHTS Hong Kong Quarter 3, 215 Retail rents in core markets plunged further Market Overview Weaker external demand amid visibly slower growth in tourist arrivals and

Citigold Private Client PROPERTY INSIGHTS Hong Kong Quarter 3, 215 Retail rents in core markets plunged further Market Overview Weaker external demand amid visibly slower growth in tourist arrivals and

Road to regaining Balance? Hong Kong office market in 2020

Road to regaining Balance? Hong Kong office market in 2020 2 ROAD TO REGAINING BALANCE? The imbalance of supply and demand would see little change until a wider range of office Clusters emerge when the

Road to regaining Balance? Hong Kong office market in 2020 2 ROAD TO REGAINING BALANCE? The imbalance of supply and demand would see little change until a wider range of office Clusters emerge when the

Hong Kong Office MarketView

Core Fringe Core Midtown Decentralised Core Fringe Core Kowloon East Decentralised Hong Kong Office MarketView Q2 2013 Global Research and Consulting OVERALL HONG KONG Rents +0.3% q-o-q CENTRAL Rents -0.2%

Core Fringe Core Midtown Decentralised Core Fringe Core Kowloon East Decentralised Hong Kong Office MarketView Q2 2013 Global Research and Consulting OVERALL HONG KONG Rents +0.3% q-o-q CENTRAL Rents -0.2%

Growing at a Slower Pace

2Q 2012 market overview research & forecast report hong kong retail market colliers international HONG KONG Growing at a Slower Pace Hong Kong s inbound tourism growth remained resilient, rising 14% YoY

2Q 2012 market overview research & forecast report hong kong retail market colliers international HONG KONG Growing at a Slower Pace Hong Kong s inbound tourism growth remained resilient, rising 14% YoY

Hong Kong Office MarketView

Hong Kong Office MarketView Q3 2013 Global Research and Consulting OVERALL HONG KONG Rents -0.3% q-o-q CENTRAL Rents -0.2% q-o-q HONG KONG ISLAND Rents -0.3% q-o-q KOWLOON Rents -0.4% q-o-q SOFTER DEMAND

Hong Kong Office MarketView Q3 2013 Global Research and Consulting OVERALL HONG KONG Rents -0.3% q-o-q CENTRAL Rents -0.2% q-o-q HONG KONG ISLAND Rents -0.3% q-o-q KOWLOON Rents -0.4% q-o-q SOFTER DEMAND

market Strong Investment Demand research & forecast report colliers international HONG KONG 4Q 2012 market overview

4Q 2012 market overview research & forecast report hong kong OFFICE market colliers international HONG KONG Strong Investment Demand Government policy restrictions on the residential sector encouraged

4Q 2012 market overview research & forecast report hong kong OFFICE market colliers international HONG KONG Strong Investment Demand Government policy restrictions on the residential sector encouraged

CHINA AND HONG KONG RESIDENTIAL MARKETS. by Knight Frank and Holdways 10 December 2014

CHINA AND HONG KONG RESIDENTIAL MARKETS by Knight Frank and Holdways 10 December 2014 CHINA S ECONOMY, POLICIES AND IMPACT ON DEVELOPERS Presented by Helen Liu General Manager, Beijing Holdways Information

CHINA AND HONG KONG RESIDENTIAL MARKETS by Knight Frank and Holdways 10 December 2014 CHINA S ECONOMY, POLICIES AND IMPACT ON DEVELOPERS Presented by Helen Liu General Manager, Beijing Holdways Information

PROPERTY INSIGHTS. Market Overview. Buoyant office take-up in CBD. Hong Kong Quarter 2, DTZ office rental index (Q =100)

PROPERTY INSIGHTS Hong Kong Quarter 2, 215 Market Overview Buoyant office take-up in CBD Demand for office space in CBD continued to be dominated by Mainland China financial institutions, however, expansion

PROPERTY INSIGHTS Hong Kong Quarter 2, 215 Market Overview Buoyant office take-up in CBD Demand for office space in CBD continued to be dominated by Mainland China financial institutions, however, expansion

Property Investment. 1. Two IFC, Central 2. International Commerce Centre, Kowloon Station 3. East Point City, Tseung Kwan O 4.

Property Investment The local retail sector has flourished and the Group s shopping centres keep attracting more visitors, benefiting retail tenants with higher traffic and turnover. The Group will keep

Property Investment The local retail sector has flourished and the Group s shopping centres keep attracting more visitors, benefiting retail tenants with higher traffic and turnover. The Group will keep

FY2013 Annual Results. 26 September New World One Step Forward We Create New Living Experience

FY2013 Annual Results 26 September 2013 New World One Step Forward We Create New Living Experience Disclaimer IMPORTANT NOTICE The information contained in these materials is intended for reference and

FY2013 Annual Results 26 September 2013 New World One Step Forward We Create New Living Experience Disclaimer IMPORTANT NOTICE The information contained in these materials is intended for reference and

Hong Kong Office MarketView

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Hong Kong Office MarketView Q1 2013 Global Research and Consulting OVERALL

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Hong Kong Office MarketView Q1 2013 Global Research and Consulting OVERALL

market A Rebound in research & forecast report colliers international HONG KONG 3Q 2012 market overview

3Q 2012 market overview research & forecast report hong kong OFFICE market colliers international HONG KONG A Rebound in 2013 Despite the soft leasing demand during the quarter with overall net take-up

3Q 2012 market overview research & forecast report hong kong OFFICE market colliers international HONG KONG A Rebound in 2013 Despite the soft leasing demand during the quarter with overall net take-up

New World One Step Forward. We Create New Living Experience. FY2014 Annual Results 24 Sep 2014

New World One Step Forward We Create New Living Experience FY2014 Annual Results 24 Sep 2014 Disclaimer IMPORTANT NOTICE The information contained in these materials is intended for reference and general

New World One Step Forward We Create New Living Experience FY2014 Annual Results 24 Sep 2014 Disclaimer IMPORTANT NOTICE The information contained in these materials is intended for reference and general

BUILDING FOR THE BETTER CHINA. Hong Kong

CHINA Hong Kong BUILDING FOR THE BETTER The Group always strives to maximize the aesthetic potential of development lots so as to integrate its projects into their surroundings harmoniously with minimal

CHINA Hong Kong BUILDING FOR THE BETTER The Group always strives to maximize the aesthetic potential of development lots so as to integrate its projects into their surroundings harmoniously with minimal

colliers international HONG KONG A Mild Correction

2Q 2012 market overview research & forecast report hong kong office market colliers international HONG KONG A Mild Correction Despite that the Eurozone debt crisis has re-intensified on a higher risk of

2Q 2012 market overview research & forecast report hong kong office market colliers international HONG KONG A Mild Correction Despite that the Eurozone debt crisis has re-intensified on a higher risk of

Property Investment. International Commerce Centre, Kowloon Station 38 SUN HUNG KAI PROPERTIES LIMITED

Property Investment International Commerce Centre, Kowloon Station 38 SUN HUNG KAI PROPERTIES LIMITED With over six million square feet of investment property under development in Hong Kong and other projects

Property Investment International Commerce Centre, Kowloon Station 38 SUN HUNG KAI PROPERTIES LIMITED With over six million square feet of investment property under development in Hong Kong and other projects

Briefing Residential sales June 2018

Savills World Research Hong Kong Briefing Residential sales June 2 SUMMARY Local interest rates may finally rise given capital outflows and rising interbank rates. Image: Plantation Road, The Peak The

Savills World Research Hong Kong Briefing Residential sales June 2 SUMMARY Local interest rates may finally rise given capital outflows and rising interbank rates. Image: Plantation Road, The Peak The

HK Island Central. Central / Admiralty / Sheung Wan Admiralty Centre ifc (International Finance Centre) (One & Two) Shanghai Commercial Bank Building

Homeasy Services Limited CT Catalyst Air Purification Service Job Reference of Commercial Buildings/Units (in alphabetical order) HK Island Central Central / Admiralty / Sheung Wan Admiralty Centre ifc

Homeasy Services Limited CT Catalyst Air Purification Service Job Reference of Commercial Buildings/Units (in alphabetical order) HK Island Central Central / Admiralty / Sheung Wan Admiralty Centre ifc

MTR Kwun Tong Line Extends to Ho Man Tin and Whampoa Stations From 23 October 2016

PR081/16 21 September 2016 MTR Kwun Tong Line Extends to Ho Man Tin and Whampoa Stations From 23 October 2016 Commuters travelling to and from Ho Man Tin and Whampoa will be able to enjoy the convenience

PR081/16 21 September 2016 MTR Kwun Tong Line Extends to Ho Man Tin and Whampoa Stations From 23 October 2016 Commuters travelling to and from Ho Man Tin and Whampoa will be able to enjoy the convenience

SUN HUNG KAI PROPERTIES LIMITED ANNUAL REPORT 2001/02

38 39 PROPERTY INVESTMENT The Group maintains an optimal tenant mix in its investment property portfolio, and strives to raise the standard of customer and tenant service. Aiming to be the landlord of

38 39 PROPERTY INVESTMENT The Group maintains an optimal tenant mix in its investment property portfolio, and strives to raise the standard of customer and tenant service. Aiming to be the landlord of

Sharper fall in office rents and capital values

Research & Forecast Report SINGAPORE OFFICE Q1 2016 Sharper fall in office rents and capital values Joanna Chen Manager, Research and Advisory The office market faces a critical juncture in the next few

Research & Forecast Report SINGAPORE OFFICE Q1 2016 Sharper fall in office rents and capital values Joanna Chen Manager, Research and Advisory The office market faces a critical juncture in the next few

Shatin to Central Link. Transport Advisory Committee 4 May 2011

Shatin to Central Link Transport Advisory Committee 4 May 2011 MTR Corporation 05/05/2011 Page 1 Background One of the ten major infrastructure projects in 2007-2008 Policy Address Government invited MTRCL

Shatin to Central Link Transport Advisory Committee 4 May 2011 MTR Corporation 05/05/2011 Page 1 Background One of the ten major infrastructure projects in 2007-2008 Policy Address Government invited MTRCL

Gross Rental Income* Gross Rental Income* by Sector

Property Investment The Group strives to generate better returns from its rental portfolio by continually monitoring the needs of its valued tenants closely. It will keep upgrading its investment portfolio

Property Investment The Group strives to generate better returns from its rental portfolio by continually monitoring the needs of its valued tenants closely. It will keep upgrading its investment portfolio

FY2015 Annual Results 24 Sep 2015 THE ARTISANAL MOVEMENT

FY2015 Annual Results 24 Sep 2015 THE ARTISANAL MOVEMENT DISCLAIMER IMPORTANT NOTICE The information contained in these materials is intended for reference and general information purposes only. Neither

FY2015 Annual Results 24 Sep 2015 THE ARTISANAL MOVEMENT DISCLAIMER IMPORTANT NOTICE The information contained in these materials is intended for reference and general information purposes only. Neither

Industrial rents shrug off retail market slowdown to reach new high

MARKETVIEW Hong Kong Industrial, Q3 2015 Industrial rents shrug off retail market slowdown to reach new high Warehouse +0.9% q-o-q Factories Flat q-o-q I/O +1.3% q-o-q External trade, container throughput

MARKETVIEW Hong Kong Industrial, Q3 2015 Industrial rents shrug off retail market slowdown to reach new high Warehouse +0.9% q-o-q Factories Flat q-o-q I/O +1.3% q-o-q External trade, container throughput

FOR VIBRANT LIFESTYLES THE REACH, YUEN LONG, HONG KONG

FOR VIBRANT LIFESTYLES THE REACH, YUEN LONG, HONG KONG Review of Operations Business in Hong Kong Progress of Major Development Projects Status of property developments with anticipated completion during

FOR VIBRANT LIFESTYLES THE REACH, YUEN LONG, HONG KONG Review of Operations Business in Hong Kong Progress of Major Development Projects Status of property developments with anticipated completion during

Kowloon Region. Unit No. District Meeting Venue & Contact Tel. Meeting Time. The Salvation Army Chuk Yuen Children and Youth Centre

Kowloon Region Happy Bee (Age: 4-6) 84 KLN HBH vacancy K3) Lok Fu The Salvation Army Chuk Yuen Children and Youth Centre (2/F, Chuk Yuen (South) Estate,Community Centre,. Tel: 2351 5321 5:30 pm-6:30pm

Kowloon Region Happy Bee (Age: 4-6) 84 KLN HBH vacancy K3) Lok Fu The Salvation Army Chuk Yuen Children and Youth Centre (2/F, Chuk Yuen (South) Estate,Community Centre,. Tel: 2351 5321 5:30 pm-6:30pm

Project Summary Major Property Development Projects in Hong Kong. Project Summary Major Property Development Projects in Hong Kong.

Project Summary Major Property Development Projects in Hong Kong Project Summary Major Property Development Projects in Hong Kong Queen s Terrace Parc Palais 10 Seaview Crescent Wang Chau Yuen Long 31

Project Summary Major Property Development Projects in Hong Kong Project Summary Major Property Development Projects in Hong Kong Queen s Terrace Parc Palais 10 Seaview Crescent Wang Chau Yuen Long 31

GREATER CHINA Quarterly

RESEARCH Q3 2011 GREATER CHINA Quarterly bright outlook for office market Beijing In the third quarter of 2011, Towers F and H of Phoenix Place in Beijing with a total gross floor area of 46,000 sq m were

RESEARCH Q3 2011 GREATER CHINA Quarterly bright outlook for office market Beijing In the third quarter of 2011, Towers F and H of Phoenix Place in Beijing with a total gross floor area of 46,000 sq m were

Annual Results SEHK Stock Code: 127

SEHK Stock Code: 127 Results Highlights Business Review Business Outlook - Mr. Ming Wai Lau, Director Financial Review - Mr. K. W. Lam, Group Financial Controller Results Highlights Business Review Business

SEHK Stock Code: 127 Results Highlights Business Review Business Outlook - Mr. Ming Wai Lau, Director Financial Review - Mr. K. W. Lam, Group Financial Controller Results Highlights Business Review Business

Summaries. FY2015 Interim Results 27 Feb 2015

Summaries 1 FY2015 Interim Results 27 Feb 2015 Disclaimer IMPORTANT NOTICE The information contained in these materials is intended for reference and general information purposes only. Neither the information

Summaries 1 FY2015 Interim Results 27 Feb 2015 Disclaimer IMPORTANT NOTICE The information contained in these materials is intended for reference and general information purposes only. Neither the information

Will The Downtrend End Sooner

1Q 2012 market overview research & forecast report hong kong real estate market colliers international HONG KONG Will The Downtrend End Sooner Rather Than Later? Even in the face of unchanged trends on

1Q 2012 market overview research & forecast report hong kong real estate market colliers international HONG KONG Will The Downtrend End Sooner Rather Than Later? Even in the face of unchanged trends on

PROPERTY ANNUAL REPORT

PROPERTY 6 ANNUAL REPORT 2001 Review of Operations Property 2001 2000 HK$M HK$M Gross rental income derived from Offices 2,261 2,251 Retail 2,144 1,989 Residential 348 372 Other income 75 80 Property investment

PROPERTY 6 ANNUAL REPORT 2001 Review of Operations Property 2001 2000 HK$M HK$M Gross rental income derived from Offices 2,261 2,251 Retail 2,144 1,989 Residential 348 372 Other income 75 80 Property investment

MTR Transformation of CBDs in Hong Kong

MTR Transformation of CBDs in Hong Kong Thomas Ho Property Director, MTR Corporation 17 September 2011 港鐵公司 19/09/2011 Page 1 How MTR Helps to Transform the CBDs? 2 Evolution of Hong Kong s CBDs 1970 Today

MTR Transformation of CBDs in Hong Kong Thomas Ho Property Director, MTR Corporation 17 September 2011 港鐵公司 19/09/2011 Page 1 How MTR Helps to Transform the CBDs? 2 Evolution of Hong Kong s CBDs 1970 Today

Self Service Terminal Service Hour Hong Kong District Branch

Self Service Terminal Service Hour Hong Kong District Branch Head Office 83 Des Voeux Central 24 hours X 09:00-19:00 09:00-19:00 09:00-19:00 Aberdeen 10 Nam Ning Street Causeway Bay Prestige & 28 Yee Wo

Self Service Terminal Service Hour Hong Kong District Branch Head Office 83 Des Voeux Central 24 hours X 09:00-19:00 09:00-19:00 09:00-19:00 Aberdeen 10 Nam Ning Street Causeway Bay Prestige & 28 Yee Wo

UDIA WA PROPERTY MARKET STATISTICS

UDIA WA PROPERTY MARKET STATISTICS FEBRUARY 218 1 IN THIS ISSUE KEY TRENDS INDUSTRY UPDATE 3 4 ECONOMY RESIDENTIAL LAND DEVELOPMENT RESIDENTIAL PROPERTY SETTLEMENTS RESIDENTIAL PROPERTY MARKET RESIDENTIAL

UDIA WA PROPERTY MARKET STATISTICS FEBRUARY 218 1 IN THIS ISSUE KEY TRENDS INDUSTRY UPDATE 3 4 ECONOMY RESIDENTIAL LAND DEVELOPMENT RESIDENTIAL PROPERTY SETTLEMENTS RESIDENTIAL PROPERTY MARKET RESIDENTIAL

Property. Mashreq. Economic Overview. Wealth Gauge.

Economic Overview United Arab Emirates has continued to benefit from surging confidence, safeheaven status, rising population and stable world class real estate market opportunities. The macroeconomic

Economic Overview United Arab Emirates has continued to benefit from surging confidence, safeheaven status, rising population and stable world class real estate market opportunities. The macroeconomic

Delia Memorial School (Hip Wo) Guidance notes on filling Student s Particulars Record

Delia Memorial School (Hip Wo) Guidance notes on filling Student s Particulars Record 2014-2015 Part (1) Candidate s Particulars: Name in English STRN No. Given Name Surname Name in Chinese Sex C C Code

Delia Memorial School (Hip Wo) Guidance notes on filling Student s Particulars Record 2014-2015 Part (1) Candidate s Particulars: Name in English STRN No. Given Name Surname Name in Chinese Sex C C Code

Property. Mashreq. Economic Overview. Wealth Gauge

Wealth Gauge Volume 23 November 2015 Economic Overview In spite of the dip in Global Oil prices the GDP for 2015 grew at 3.5. The UAE economic growth is expected to slow down and grow at 2.9 in 2016 driven

Wealth Gauge Volume 23 November 2015 Economic Overview In spite of the dip in Global Oil prices the GDP for 2015 grew at 3.5. The UAE economic growth is expected to slow down and grow at 2.9 in 2016 driven

New Business Districts Why Success or Failure

New Business Districts Why Success or Failure Date : 17 September 2011 By Augustine Wong Henderson Land Development Co. Ltd. Traditional Business Districts Insufficient land for new developments Source

New Business Districts Why Success or Failure Date : 17 September 2011 By Augustine Wong Henderson Land Development Co. Ltd. Traditional Business Districts Insufficient land for new developments Source

The highly distinctive Manulife Financial Centre sets a precedent for the regeneration of the older districts of Hong Kong, providing over one

Gateway to the future The highly distinctive Manulife Financial Centre sets a precedent for the regeneration of the older districts of Hong Kong, providing over one million square feet of Grade-A office

Gateway to the future The highly distinctive Manulife Financial Centre sets a precedent for the regeneration of the older districts of Hong Kong, providing over one million square feet of Grade-A office

AVT CONTRACTING. Shanghai Head Offi ce. Branch Offi ce CHINA Class 2 Qualification for Specialized Contracting of Architectural Decoration Project

PROJECT REFERENCE AVT CONTRACTING AVT CONTRACTING is a subsidiary company of AVT DESIGN. We are Registered Contractor delivering Interior Fitting Out Work, A&A and Minor Work, as well as Design and Fitting

PROJECT REFERENCE AVT CONTRACTING AVT CONTRACTING is a subsidiary company of AVT DESIGN. We are Registered Contractor delivering Interior Fitting Out Work, A&A and Minor Work, as well as Design and Fitting

Property Development. 1. YOHO Town, Yuen Long 2. Park Island, Ma Wan 3. Severn 8, The Peak 4. The Arch, Kowloon Station. Park Island, Ma Wan

Property Development The Group s trusted brand name for quality enhances marketability and development margins on new projects. It will continue satisfying homebuyers by offering premiumquality developments

Property Development The Group s trusted brand name for quality enhances marketability and development margins on new projects. It will continue satisfying homebuyers by offering premiumquality developments

UDIA WA PROPERTY MARKET STATISTICS

UDIA WA PROPERTY MARKET STATISTICS OCTOBER 217 1 IN THIS ISSUE KEY TRENDS INDUSTRY UPDATE 3 4 ECONOMY RESIDENTIAL LAND DEVELOPMENT RESIDENTIAL PROPERTY SETTLEMENTS RESIDENTIAL PROPERTY MARKET RESIDENTIAL

UDIA WA PROPERTY MARKET STATISTICS OCTOBER 217 1 IN THIS ISSUE KEY TRENDS INDUSTRY UPDATE 3 4 ECONOMY RESIDENTIAL LAND DEVELOPMENT RESIDENTIAL PROPERTY SETTLEMENTS RESIDENTIAL PROPERTY MARKET RESIDENTIAL

Property. Mashreq. Economic Overview. Wealth Gauge. Exceptional. Individual.

Exceptional. Individual. Volume 14 October Economic Overview United Arab Emirates has continued to benefit its safe-heaven status. The economic recovery has been strong which is well supported by tourism,

Exceptional. Individual. Volume 14 October Economic Overview United Arab Emirates has continued to benefit its safe-heaven status. The economic recovery has been strong which is well supported by tourism,

BANK OF CHINA LIMITED (A joint stock company incorporated in the People s Republic of China with limited liability) Stock Code: 3988

This announcement is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities. The Stock Exchange of Hong Kong Limited and Hong Kong

This announcement is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities. The Stock Exchange of Hong Kong Limited and Hong Kong

Property. Mashreq. Economic Overview. Wealth Gauge.

Economic Overview The UAE economy has registered a growth of 5.2 in 2013. In spite of the dip in Oil prices globally the economy is expected to have registered a GDP growth between 4.7-4.8 in 2014. The

Economic Overview The UAE economy has registered a growth of 5.2 in 2013. In spite of the dip in Oil prices globally the economy is expected to have registered a GDP growth between 4.7-4.8 in 2014. The

MISCELLANEOUS http://info.sgx.com/webcorannc.nsf/vwprint/5a360f118384253a482570830013800d?op... Page 1 of 1 9/21/2005 Print this page Miscellaneous * Asterisks denote mandatory information Name of Announcer

MISCELLANEOUS http://info.sgx.com/webcorannc.nsf/vwprint/5a360f118384253a482570830013800d?op... Page 1 of 1 9/21/2005 Print this page Miscellaneous * Asterisks denote mandatory information Name of Announcer

and 66 Jardine s Bazaar, will greatly improve the Group s gearing. Financial Information

Company Research Report Company Research Report Date Industry 2011/06/30 Property Closing Price Target Price HK$1.76 HK$3.00 Share Information Outstanding Shares (bn) 3.67 Market Cap (HK$bn) 6.45 6-mth

Company Research Report Company Research Report Date Industry 2011/06/30 Property Closing Price Target Price HK$1.76 HK$3.00 Share Information Outstanding Shares (bn) 3.67 Market Cap (HK$bn) 6.45 6-mth

Progress Update on Shatin to Central Link (SCL) 2 May 2013

Progress Update on Shatin to Central Link (SCL) 2 May 2013 MTR Corporation 02/05/2013 Page 1 Alignment Tai Wai Hin Keng SCL (Tai Wai to Hung Hom Section) Diamond Hill Kai Tak To Kwa Wan Ma Tau Wai Ho Man

Progress Update on Shatin to Central Link (SCL) 2 May 2013 MTR Corporation 02/05/2013 Page 1 Alignment Tai Wai Hin Keng SCL (Tai Wai to Hung Hom Section) Diamond Hill Kai Tak To Kwa Wan Ma Tau Wai Ho Man

(Stock Code: 1881) Managed by SUMMARY OF MARKET RENTAL PACKAGE OF INITIAL HOTEL PROPERTIES IN RESPECT OF THE 2018 FISCAL YEAR

The Securities and Futures Commission of Hong Kong, Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make

The Securities and Futures Commission of Hong Kong, Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make

CHINESE ESTATES HOLDINGS LIMITED (Incorporated in Bermuda with limited liability) (Stock Code: 127)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness

Appendix: List of CLP Power s EV charging stations (14 December 2018)

Appendix: List of CLP Power s EV charging stations (14 December 2018) Quick EV charging stations No. Location Address Parking Bay Qty. District Type 1 CLP Centenary Building CLP Centenary Building, G/F

Appendix: List of CLP Power s EV charging stations (14 December 2018) Quick EV charging stations No. Location Address Parking Bay Qty. District Type 1 CLP Centenary Building CLP Centenary Building, G/F

Has The Office Market Reached A Peak? Vacancy. Rental Rate. Net Absorption. Construction. *Projected $3.65 $3.50 $3.35 $3.20 $3.05 $2.90 $2.

Research & Forecast Report OAKLAND METROPOLITAN AREA OFFICE Q1 Has The Office Market Reached A Peak? > > Vacancy remained low at 5. > > Net Absorption was positive 8,399 in the first quarter > > Gross

Research & Forecast Report OAKLAND METROPOLITAN AREA OFFICE Q1 Has The Office Market Reached A Peak? > > Vacancy remained low at 5. > > Net Absorption was positive 8,399 in the first quarter > > Gross

Soft Land Market in 2017

Research & Forecast Report LAND Q4 217 Soft Land Market in 217 > > Land sales in 217 fell behind 216 > > A lack of large sales at Apex brought the average price per square foot up > > Strong development

Research & Forecast Report LAND Q4 217 Soft Land Market in 217 > > Land sales in 217 fell behind 216 > > A lack of large sales at Apex brought the average price per square foot up > > Strong development

MTR to work closely and align with the Government on announcement mechanism in relation to Railway Protection Area

PR068/18 6 August 2018 MTR to work closely and align with the Government on announcement mechanism in relation to Railway Protection Area The MTR Corporation notes that a new announcement mechanism has

PR068/18 6 August 2018 MTR to work closely and align with the Government on announcement mechanism in relation to Railway Protection Area The MTR Corporation notes that a new announcement mechanism has

S.F. Service Points Update Notice

Points Update Notice The update of Points during 16 th Mar 2018 to 15 th May 2018 is as follows: Business Effective Date District Address Points Code Types Business Hours (Mon-Fri) Business Hours (Sat)

Points Update Notice The update of Points during 16 th Mar 2018 to 15 th May 2018 is as follows: Business Effective Date District Address Points Code Types Business Hours (Mon-Fri) Business Hours (Sat)

Briefing Office and retail

Savills China Research Dalian Briefing Office and retail August 218 Image: Labor Park, Qingniwa Area, Zhongshan District SUMMARY A lack of new supply saw rents and occupancy rates in both the Grade A office

Savills China Research Dalian Briefing Office and retail August 218 Image: Labor Park, Qingniwa Area, Zhongshan District SUMMARY A lack of new supply saw rents and occupancy rates in both the Grade A office

Industrial Property Transactions Nearly Doubled In 4Q 2012

4Q 212 market overview research & forecast report hong kong industrial market Industrial Property Transactions Nearly Doubled In 4Q 212 market indicators ForEcast overall performance New supply Tenant

4Q 212 market overview research & forecast report hong kong industrial market Industrial Property Transactions Nearly Doubled In 4Q 212 market indicators ForEcast overall performance New supply Tenant

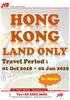

HONG KONG LAND ONLY. Travel Period : 01 Oct 2018 ~ 02 Jan fr. S$150

HONG KONG LAND ONLY Travel Period : 01 Oct 2018 ~ 02 Jan 2019 fr. S$150 Sheung Shui International Airport Hong Kong Disneyland Tsuen Wan 1 10 3 9 24 Mongkok 11 4 12 18 23 13 Tsim Sha Tsui 19 21 Causeway

HONG KONG LAND ONLY Travel Period : 01 Oct 2018 ~ 02 Jan 2019 fr. S$150 Sheung Shui International Airport Hong Kong Disneyland Tsuen Wan 1 10 3 9 24 Mongkok 11 4 12 18 23 13 Tsim Sha Tsui 19 21 Causeway